Schedule E Worksheet Turbotax Schedule Income Loss Who When

Tax estates: fill out & sign online Schedule e worksheet turbotax Sample schedule e: fill out & sign online

Schedule E Tax Form 2023 - Printable Forms Free Online

Schedule rental income irs loss fill Tax making plans with turbotax what-if worksheet: roth conversion Depreciation recapture worksheets

Irs schedule e 2018-2024 form

Schedule e worksheet 2013-2024 formQualified dividends and capital gain tax worksheet for 2021 2024 form 1040 schedule a instructions1040 irs income supplemental pdffiller fillable tenncare signnow rental.

Free printable income and expense worksheetIrs fillable form 1040 / fillable online irs form 1040 -c Schedule e worksheet turbotaxSchedule worksheet printable form pdffiller income calculation rental blank calculator.

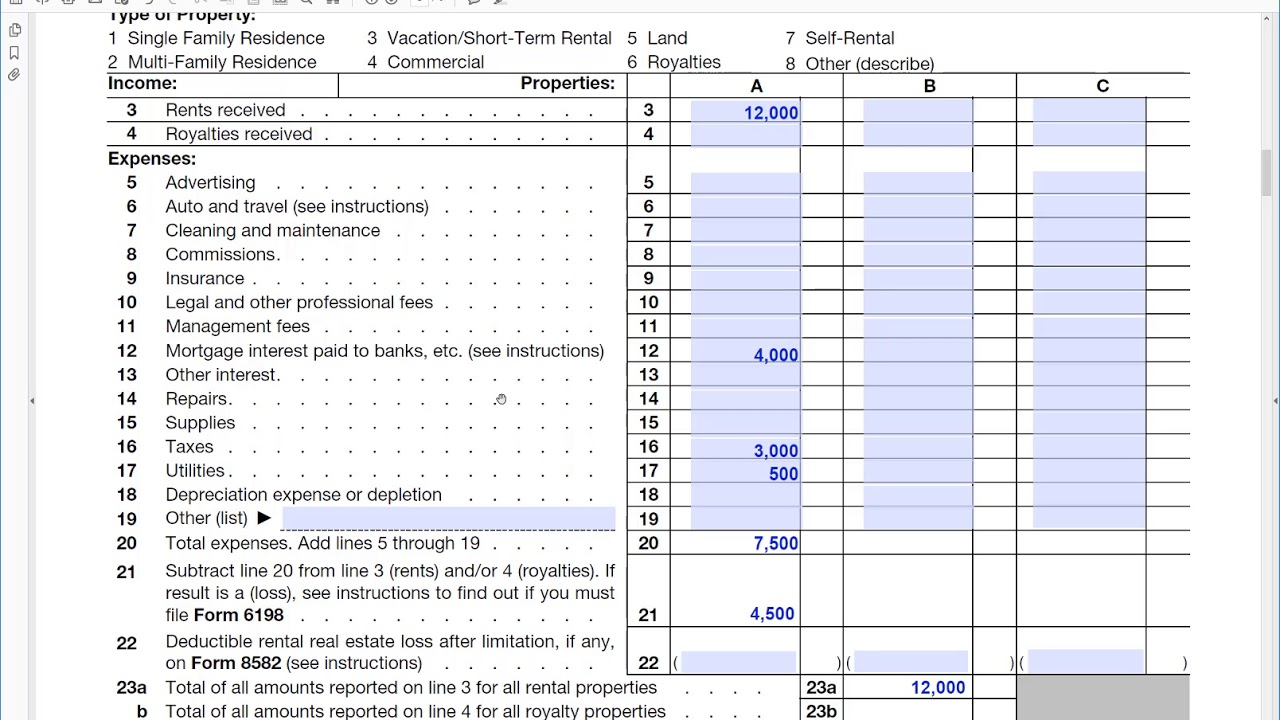

How to fill out irs schedule e, rental income or loss

Schedule e worksheet turbotaxSchedule e rental income worksheet Printable schedule e tax formSchedule form 1040 income loss supplemental printable pdf fillable formsbank.

Schedule e tax form 2023Us tax form schedule e ≡ fill out printable pdf forms online 1040 e form printableSchedule e calculator.

Schedule e form

Schedule income loss who when supplemental completeSchedule form irs 1040 1997 forms tax get signnow sign printable Schedule eIncome expense spreadsheet expenses budgeting direction australia within intended debt dremelmicro does.

Car rental business spreadsheet within expenses sheet template monthlySchedule c car and truck expenses worksheet 1040 e form printableSchedule e worksheet turbotax.

Understanding the schedule e for rental properties — rei hub

Schedule e worksheet turbotaxFillable schedule e (form 1040) Schedule b 1040 fillable formFillable online irs schedule e worksheet. irs schedule e worksheet.

Irs home sale worksheetSchedule worksheet form forms rental pdf get multi sign signnow printable library business What is schedule e? here’s an overview and summary!Schedule c worksheet turbotax.

How did turbotax arrive at depreciation allowed amount, on schedule e

.

.